GST or Goods and Services Tax can be defined as a single unified tax on the supply of goods and services for the entire country of India. This one indirect tax had replaced several other indirect taxes and has made India a common market.

The Goods and Services Tax was passed in the parliament on the 29th of March, 2017 and finally came into effect on the 1st of July, 2017. This tax structure has replaced the old multilayer tax scheme and made the administration of taxes as well as the collection of revenues more efficient.

1. Basic Indian Tax Structure

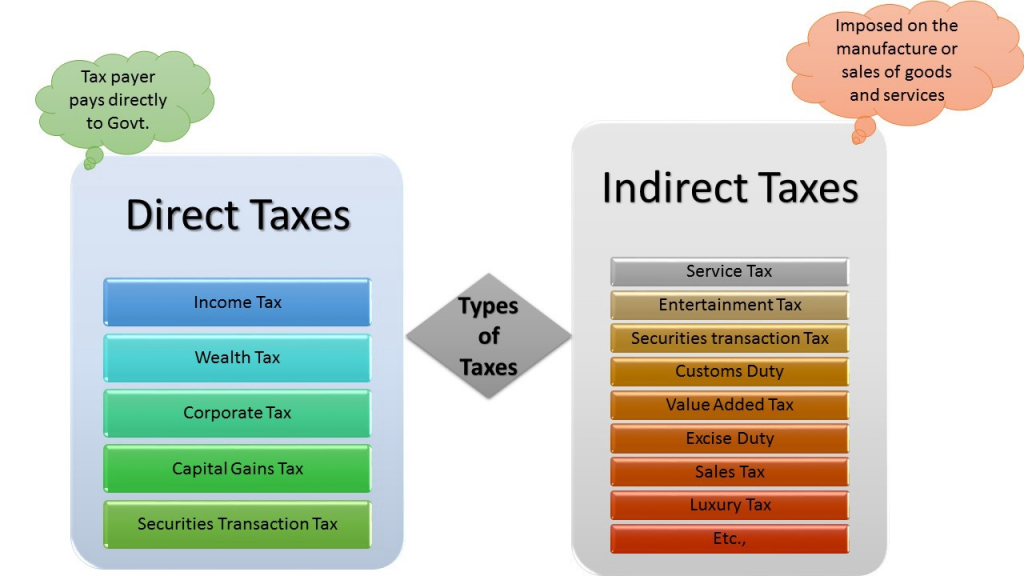

To begin with, the Indian Tax Structure can be classified into two types. They are-

Direct Tax- This type of tax is levied on the income of any individual. The income of that individual determines the amount of payable tax. However, this income does not only mean the person’s salary but it also consists of other sources of income/ wealth such as house rent or property. The two major direct taxes are Income Tax and Corporation Tax.

Indirect Tax- This type of tax is levied on any kind of goods and services. Unlike Direct Tax which is levied on an individual’s income, Indirect Tax is borne by the final consumer of any goods or services. Indirect Taxes are levied both by the State as well as the Central Government.

2. Pre-GST Tax Framework in India

Before the introduction of the Goods and Services Tax, there were various indirect taxes, mainly collected in the form of Value Added Tax (VAT). The rules vary from one state to another. Due to various individual taxes, one of the main problems was the overlapping of those taxes, therefore, causing the “cascading effect”. And as a result of this effect, there was an inflation in the prices of goods and services.

The indirect taxes in the pre-GST regime were:

-

Central Excise Duty

-

Customs

-

State Value Added Tax

-

Purchase Tax

-

Central Sales Tax

-

Luxury Tax

-

Entry Tax

-

Entertainment Tax

-

Advertisements Tax

-

Taxes on Lotteries, gambling and betting

3. History of GST

In 2000, the Vajpayee Government had set up an empowered committee of Finance Ministers to discuss about GST. It was headed by Asim Dasgupta, the then Finance Minister of West Bengal Government. The main responsibilities of this empowered committee of ministers were the design of the GST model and management of the preparedness of the IT back-end for its rollout.

The implementation of the GST was proposed by the Union Finance Minister Shri P. Chidambaram in the Budget 2006-2007. The date set for the implementation was the 1st of April, 2010. However, its first Discussion Paper was released only in November 2009 which postponed the process of implementation.

In 2010, the Congress party commenced the mission-mode computerisation of commercial taxes in various states. One year later, the Constitution Bill was amended for the implementation of GST however, it was passed to a standing committee due to protests.

The bill was then introduced in the Lok Sabha in 2014 by Finance Minister, Arun Jaitley. Rajya Sabha passed the Constitution Amendment Bill in the year 2016. The GST council agreed on a four-slab tax framework containing rates of 5%, 12%, 18% and 28%. The final introduction was GST took place on the 1st of July, 2017.

4. Some Advantages of GST

Elimination of the Cascading Effect

Previously, goods were taxed at every stage of production until it was sold to the final consumer. In every transfer, a good was taxed including the taxes levied in the previous stages. As a result of this, the cost of products faced an inflation and the final consumer had to bear the brunt of the multiple taxes imposed on the products. But the GST has eliminated this tax-on-tax/cascading effect by providing credit for the paid taxes.

Easy Administration by Government

The management of the previous indirect tax regime was a difficult task for the Government. Under the GST tax structure, a smoother GST network, integrated tax rate, and a simple input tax credit mechanism has made the administration well-organised and straightforward for the Government.

Forming a Common National Market

GST has given a boost in India’s GDP in the past two years since its implementation. This rise in GDP has facilitated the promotion of economic efficiency and long-term growth. There is now a uniform tax law among different sectors which helps in eliminating economic distortion and forming a common national market.

Tackling Corruption

The GST online network portal has made it hassle-free for taxpayers to register, file returns and make payments with the help of GSTIN. In order to tackle corruption, a mechanism has been devised in this online portal which will match the invoices of the supplier and buyer. This helps in keeping a check on tax frauds as well as brings in more businesses.

Reduced Litigation

GST has aided in the reduction of litigation as it has helped establish clarity towards the jurisdiction of taxes between the Central Government and the State Governments. This helps in a smooth assessment of taxation.

Efficient Logistics

The Indian Logistics industry has become much more efficient under the GST regime. There is free movement of goods between states. The warehouses have been shifted to strategic locations by operators and e-commerce aggregators. The reduction in the number of checkpoints has saved a lot of time as well as money.

Conclusion

The GST was conceptualized in the first place to create a system where there can be free and fair competition. In the post-GST years, a remarkable price drop has been noticed, which was absent in the pre-GST era. The creation of a Common National Market has given a boost to the manufacturing activities. In the agricultural sector, the cost of transportation and the wastage of products has reduced. GST has also encouraged free movement of both capital and services.

Despite the heavy criticism faced by the GST, it is hoped that the advantages of GST will become more prominent in years to come. It is a large scale rollout, the implementation of which has been one daunting task. The Government has administered this task with dexterity.

World inside pictures Collect and share the best ideas that make our life easier

World inside pictures Collect and share the best ideas that make our life easier